how to calculate nj taxable wages

Using our New Jersey Salary Tax Calculator. Press Calculate to see your New Jersey tax and take home breakdown including Federal Tax deductions.

File and Pay Employer Payroll Taxes Including 1099 1095 Electronic Filing Mandate.

. 0 - 9875 9876 - 40125 40126 - 85525 85526 - 163300 163301 - 207350 207351 - 518400 518401. Income Actually Taxed by Both NJ and Another Jurisdiction Income Taxable in Another Jurisdiction Exempt From Tax in NJ Income must be taxed by bothNew Jersey and the other jurisdiction to be included on Schedule NJ-COJ. Amounts received as early retirement benefits and amounts reported as pension on Schedule NJK-1 Partnership Return Form NJ-1065 are also taxable.

New Jersey Paycheck Quick Facts. How to use the advanced New Jersey tax calculator. Gross wages are the starting point from which the IRS calculates an individuals tax liability.

Related

Enter your annual income in New Jersey. In NJ return interview there will be a point in the interview that you have to select to remove the NY W-2 or it will double count the incomenote removing the NJ can also be done but will lead to a lot of adjustments for after tax in NJ items that are pretax for other states and the fed that are so check to remove the NY wages you always remove the state you dont reside. Post-Retirement Contributions to a Section 403 b Plan.

Step 3 Taxable income. The states SUTA wage base is 7000 per employee. Taxable Retirement Income.

You cant claim a deduction for your state income taxes then later receive a tax-free. Employers are required to withhold 22 percent to pay to the IRS. You must report them on Schedule A of Form 1040 if you claimed a deduction for state and local taxes the year before.

Only the highest earners are subject to this percentage. For example unemployment compensation may be taxed by another jurisdiction but it is not taxable by New Jersey so you cannot. Employer Requirement to Notify Employees of Earned Income Tax Credit.

Total Taxable Wages are all taxable wages reported to the New Jersey Department of Labor by all. How to Calculate Salary After Tax in New Jersey in 2022 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status. The Unemployment Trust Fund reserve ratio is calculated as follows.

The IRS is basically preventing double-dipping. How to use the tax calculator. Census Bureau Number of cities with local income taxes.

Mandatory Electronic Filing of 1099s How to Calculate Withhold and Pay New Jersey Income Tax Withholding Rate Tables Withholding Requirements for Certain Construction Instructions for the Employers Reports Forms NJ-927 and NJ-927-W. Since your business has. How to calculate taxable wages.

You andor your spousecivil union partner if filing jointly were 62 or older on the last day of the tax year. Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from the private sector and Keogh plans.

The total amount of money paid to an. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Enter your tax year filing status and taxable income to calculate your estimated tax rate.

There are two main types of. Your total income for the entire year was 150000 or less. Your income from wages net profits from business distributive share of partnership income and net pro rata share of S corporation income totals 3000 or less.

NJ-WT New Jersey Income Tax Withholding Instructions This Guide Contains. State income tax refunds can sometimes be considered taxable income according to the IRS. Commuter Transportation Benefit Limits.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Balance of Unemployment Trust Fund total taxable wages Unemployment Trust Fund reserve ratio.

Calculate salaried employees paychecks by dividing their salary by the number of pay periods per year. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widower. PANJ Reciprocal Income Tax Agreement.

Adjusted gross income Post-tax deductions Exemptions Taxable income. You must report all payments whether in cash benefits or property. How to calculate income tax in New Jersey in.

The more someone makes the more their income will be taxed as a percentage. In 2022 the federal income tax rate tops out at 37. Now you need to figure out your taxable income.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Balance of Unemployment Trust Fund is the balance in the Fund as of March 31st of the current year. New Jersey income tax rate.

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes Before you can start thinking about New Jersey payroll taxes you need to first calculate federal payroll taxes. The filing status affects the Federal and State tax tables used to. There are two main types of wages.

If you are a New Jersey resident wages you receive from all employers are subject to New Jersey Income Tax. Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for any overtime hours worked. The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount.

Check the box - Advanced NJS Income Tax Calculator. NJ Income Tax Wages. For post-tax deductions you can choose to either take the standard.

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

Nj Takes Another Look At Tax Bracketing Nj Spotlight News

Nj Labor Department Max Benefit Rates Increased On Jan 1 Wrnj Radio

Nj Full Year Resident Ny Wages General Chat Atx Community

The Amount Earned During Living In Nj Is Greater T

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

2020 New Jersey Payroll Tax Rates Abacus Payroll

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

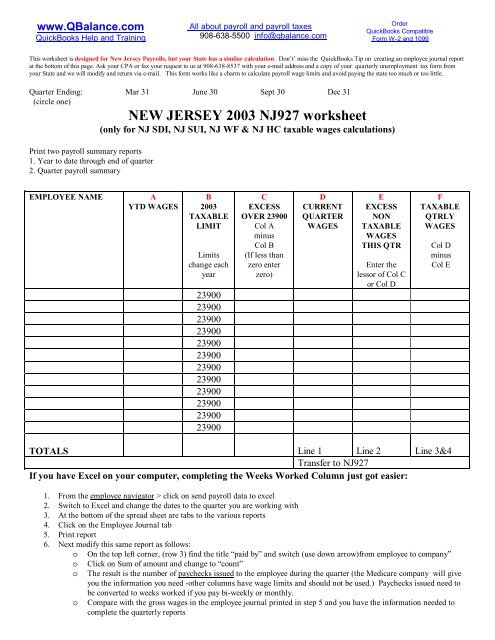

Nj927 Quarterly Worksheet Pdf File Qbalance Com

Free New Jersey Payroll Calculator 2022 Nj Tax Rates Onpay

Solved I Live In Nj But Work In Ny How Do I Enter State

Nj Full Year Resident Ny Wages General Chat Atx Community

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

How To Calculate Taxable Income H R Block

Solved New Jersey Non Resident Tax Calculating Incorrectl

New Jersey Nj Tax Rate H R Block